This product is suitable for investors who are seeking* :

- Regular Income over Short to Medium Term.

- Investment in Debt and Money Market securities such that the Macaulay duration of the portfolio is between 1 year - 3 years.

-

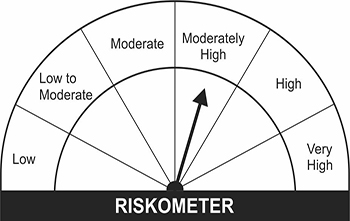

Benchmark Risckometer

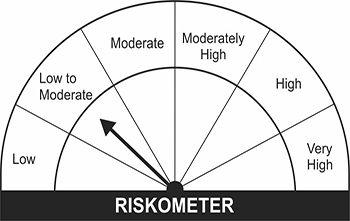

Scheme Risckometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investment Objective

The Scheme will endeavor to generate stable returns with a low risk strategy while maintaining liquidity

through a portfolio comprising of debt and money market instruments.

Investors are required to read all the scheme related information set out in the offer documents carefully

and also note that there can be no assurance that the investment objectives of the scheme will be realized.

The scheme does not guarantee/ indicate any returns.

Scheme Features

| Type of Scheme |

: |

An open-ended short duration debt scheme investing in instruments such that the Macaulay duration# of the portfolio is between 1 year and 3 years. A moderate interest rate risk and moderate credit risk. |

| Plans/Options |

: |

Regular (Growth), Regular (IDCW) – Payout / Reinvestment

Direct (Growth), Direct (IDCW) – Payout / Reinvestment |

| Investment Strategy |

: |

The focus of the scheme is to achieve the investment objective of the scheme through investments in a combination of debt and money market instruments having varied yields and maturity profile. The scheme is being positioned as a product having the essence of both debt and money market schemes. As such the product is being positioned as intervening product between the long-term debt scheme and liquid scheme. Further, the composition of maturity profile of the instruments may vary substantially from time to time depending upon the changes due to purchase and repurchase of units. The Investment strategy of the Scheme would be such that the Macaulay Duration# of the portfolio would be between 1 year -3 years. |

| Minimum Application Amount/Number of Units |

: |

Purchase : Rs. 5,000/- and any amount thereafter.

Additional Purchase : Rs. 1,000/- and any amount thereafter

Repurchase : There is no minimum limit on the amount/units which can be redeemed/switched-out. The investor is free to redeem any or all units outstanding in his/her/their folio. |

| Entry Load |

: |

NIL |

| Exit Load |

: |

NIL |

| SIP / STP / SWP Option |

: |

Available.

|

| Benchmark Index |

: |

CRISIL Short Duration Fund BII Index |

| Tax Benefits |

: |

Provisions applicable to debt schemes. For more information, click here |

| Plans / Options | Latest NAV (Rs.) |

| Regular Plan - Dividend Option | 10.9598 (26 Apr 2024) |

| Regular Plan - Growth Option | 10.9597 (26 Apr 2024) |

| (Direct) Dividend Option | 11.1180 (26 Apr 2024) |

| (Direct) Growth Option | 11.1181 (26 Apr 2024) |

|

Liquidity

|

:

|

The Scheme will offer units for sale and repurchase at NAV based prices on all business days. Unitholders can subscribe to and get their units repurchased on all business days at NAV related prices (with exit load as mandated by AMC from time to time). As per SEBI Regulations, the Fund shall dispatch Redemption proceeds within 10 Business Days of receiving the valid Redemption request. A penal interest of 15% per annum or such other rate as may be prescribed by SEBI from time to time will be paid in case the redemption proceeds are not dispatched/ remitted within 10 Business Days of the date of Redemption request. However, under normal circumstances, the Fund will endeavor to dispatch the Redemption proceeds well before 10 Business Days from the acceptance of the duly completed Redemption request.

|

|

Fund Manager

|

:

|

Primary Fund Manager - Mr. Gurvinder Singh Wasan

Secondary Fund Manager - Ms. Shalini Tibrewala

|