This product is suitable for investors who are seeking* :

- Regular Income over Short Term.

- Investment in Debt and Money Market securities such that the Macaulay duration of the portfolio is between 6 months - 12 months.

-

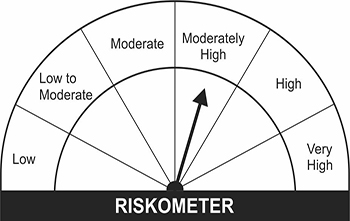

Benchmark Risckometer

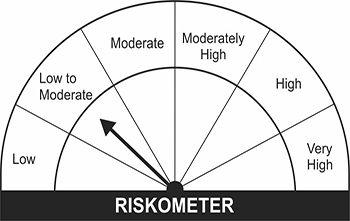

Scheme Risckometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investment Objective

To generate stable long term returns with low risk strategy and capital appreciation/accretion besides preservation of capital through

investments in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 6 months - 12 months.

Investors are required to read all the scheme related information set out in the offer documents carefully and also note that there

can be no assurance that the investment objectives of the scheme will be realized. The scheme does not guarantee/ indicate any

returns.

Scheme Features

| Inception Date |

: |

27th September, 2006 |

| Type of Scheme |

: |

An open ended low duration debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 6 to

12 months |

| Plans/Options |

: |

Regular Plan, Super Plan & Super Plus Plan with Daily Dividend, Weekly Dividend, Fortnightly Dividend, Growth & Bonus Options and (Direct) Daily Dividend, (Direct) Weekly Dividend, (Direct) Fortnightly Dividend, (Direct)Growth & (Direct) Bonus Options |

| Investment Strategy |

: |

JM Financial Mutual Fund adopts a scientific approach to investments. Securities are selected for various funds by the fund managers based on a continuous study of trends in industries and companies, including management capabilities, global competitiveness, earning power, growth/payout features and other relevant investment criteria, which would, inter alia, include evaluation of the outlook of the economy, exposure to various industries and geographical regions, evaluation of the intrinsic worth of specific opportunities such as primary market transactions, private placements, etc. |

| Minimum Application Amount/Number of Units |

: |

Purchase : Rs. 5,000/- or any amount thereafter

Additional Purchase : Rs. 1,000/- & any amount thereafter Repurchase : There is no minimum limit on the amount/units which can be redeemed/switched-out. The investor is free to redeem any or all units outstanding in his/her/their folio. |

| Entry Load |

: |

NIL

|

| Exit Load |

: |

NIL

|

| SIP / STP / SWP Option |

: |

Available.

|

| Benchmark Index |

: |

CRISIL Low Duration Fund BI Index |

| Tax Benefits |

: |

Provisions applicable to debt schemes. For more information, click here |

| Plans / Options | Latest NAV (Rs.) |

| (Regular) - Daily IDCW (Reinvestment) | 10.8200 (26 Apr 2024) |

| Growth Option | 33.9807 (26 Apr 2024) |

| (Regular) - Weekly IDCW (Reinvestment) | 11.4141 (26 Apr 2024) |

| (Direct) - Daily IDCW (Reinvestment) | 10.8500 (26 Apr 2024) |

| (Direct) - Weekly IDCW (Reinvestment) | 11.4545 (26 Apr 2024) |

| (Direct) Growth Option | 34.7388 (26 Apr 2024) |

| Bonus Option - Principal Units | 20.4723 (26 Apr 2024) |

| Bonus Option - Bonus Units | 0.0000 () |

| (Direct) Bonus Option - Principal Units | 20.9165 (26 Apr 2024) |

| (Direct) Bonus Option - Bonus Units | 0.0000 () |

|

Liquidity

|

:

|

Purchase and redemption of Units at NAV based prices on all Business Days. It will be our endeavour to dispatch redemption proceeds at T+1 working days. However, as per regulations, the Fund is required to dispatch redemption proceeds within 10 Business days of receiving valid redemption request.

|

|

Fund Manager

|

:

|

Primary Fund Manager - Ms. Shalini Tibrewala

(Managing this Scheme since August 20, 2021 and has over 23 years of experience in the financial services sector).

Secondary Fund Manager - Mr. Gurvinder Singh Wasan

(Managing this Scheme since April 5, 2022 & has around 18 years of experience in the field of fixed income markets).

|

Click here for Monthly Portfolios

Click here for Scheme

Performance

Click here for Scheme Comparison