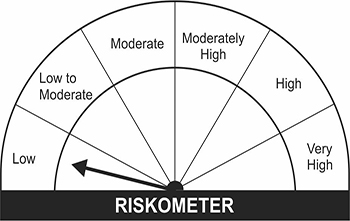

This product is suitable for investors who are seeking* :

- Short Term savings.

- Reasonable returns commensurate with low risk and providing a high level of liquidity.

-

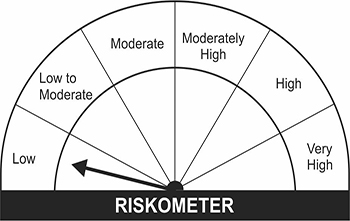

Benchmark Risckometer

Scheme Risckometer

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investment Objective

The Scheme aims to provide reasonable returns commensurate with low risk and providing a high level of liquidity, through investments made primarily in overnight securities having maturity of 1 business day.

Investors are required to read all the scheme related information set out in this document carefully and also note that there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/ indicate any returns.

Scheme Features

| Inception Date |

: |

4th, December 2019 |

| Type of Scheme |

: |

An open ended debt scheme investing in overnight securities. |

| Plans/Options |

: |

Daily Dividend (Reinvestment Option), Weekly Dividend (Payout & Reinvestment Option), Growth,(Direct) Daily Dividend (Reinvestment Option), (Direct) Weekly Dividend (Payout & Reinvestment Option), (Direct) Growth |

| Investment Strategy |

: |

The Scheme aims to identify securities which offer optimal level of yields/returns, considering risk-reward ratio. An appropriate mix of cash and money market securities will be used to achieve this. The Scheme will invest in Debt and money market securities getting matured on next business day. Money Market securities include cash and cash equivalents.

The AMC may consider the ratings of such Rating Agencies as approved by SEBI to carry out the functioning of rating agencies. In addition, the investment team of the AMC will study the macro economic conditions, including the political, economic environment and factors affecting liquidity and interest rates. The AMC would use this analysis to attempt to predict the likely direction of interest rates and position the portfolio appropriately to take advantage of the same.

The Scheme may undertake repo transactions in corporate debt securities in accordance with the directions issued by RBI and SEBI from time to time. Such investment shall be made subject to the guidelines which may be prescribed.

|

| Minimum Application Amount/Number of Units |

: |

Purchase : Rs. 5,000/- and any amount thereafter.

Additional Purchase : Rs. 1,000/- and any amount thereafter

Repurchase : Minimum redemption from existing Unit Accounts for normal transactions other than through STP/SWP would be a) Rs. 500 and any amount thereafter OR b) 50 units or any number of units there after subject to keeping a minimum balance of 500 units or Rs. 5000/- whichever is less. c) for all the units in the folio for the respective plan if the available balance is less than Rs. 500/- or less than 50 units on the day of submission of valid redemption request. |

| Entry Load |

: |

NIL |

| Exit Load |

: |

NIL |

| Dividend Frequency |

: |

Regular Plan - Daily / Weekly, Direct Plan - Daily / Weekly |

| SIP / STP / SWP Option |

: |

Available.

|

| Benchmark Index |

: |

CRISIL Overnight Fund AI Index |

| Tax Benefits |

: |

Provisions applicable to debt schemes. For more information, click here |

| Plans / Options | Latest NAV (Rs.) |

| (Regular) - Daily IDCW (Reinvestment) | 1000.0000 (28 Apr 2024) |

| (Direct) - Daily IDCW (Reinvestment) | 1000.0000 (28 Apr 2024) |

| (Regular) - Weekly IDCW (Payout) | 1000.8910 (28 Apr 2024) |

| (Direct) - Weekly IDCW (Payout) | 1000.9100 (28 Apr 2024) |

| Growth Option | 1218.4626 (28 Apr 2024) |

| (Direct) Growth Option | 1222.2058 (28 Apr 2024) |

|

Liquidity

|

:

|

Purchase and redemption of Units at NAV based prices on all Business Days. It will be our endeavour to dispatch redemption proceeds at T+1 working days. However, as per regulations, the Fund is required to dispatch redemption proceeds within 10 Business days of receiving valid redemption request

|

|

Fund Manager

|

:

|

Primary Fund Manager - Shalini Tibrewala

(Managing this fund since December, 2019 and has over 23 years of

experience in the financial services sector).

Secondary Fund Manager - Naghma Khoja

(Managing this Scheme since April 5, 2022 and has more than 5 years of

experience in the asset management industry).

|

Click here for Monthly Portfolios

Click here for Scheme

Performance

Click here for Scheme Comparison